Fuel Tax System

Powerful software for compliant IFTA reporting

Fuel Tax System offers you a compliant, efficient and easy-to-use solution for the production of your IFTA reports, distance reports and IRP renewal.

A web-based application, it records all your data, from fuel purchases to kilometers traveled, including toll booths. Updates to software and quarterly IFTA rates are automatic. Whether you’re at home, in the office, or on the road, you’ll always have access to your software and data.

Features tailored to your needs

1.

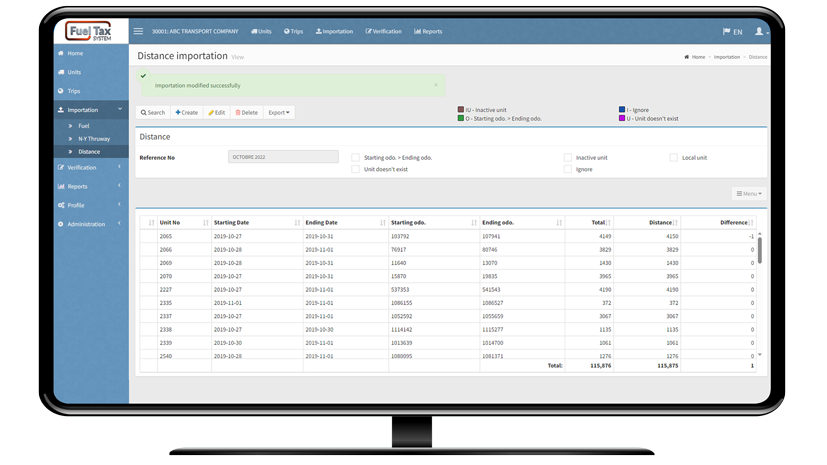

Imports your data

2.

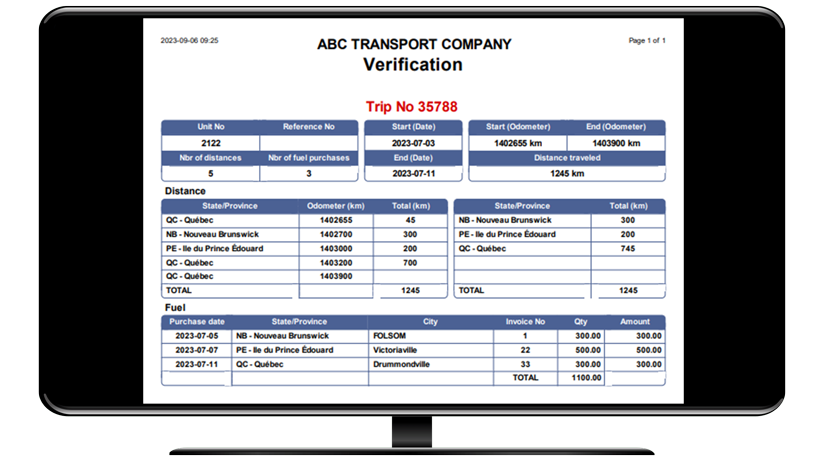

Validates your data

3.

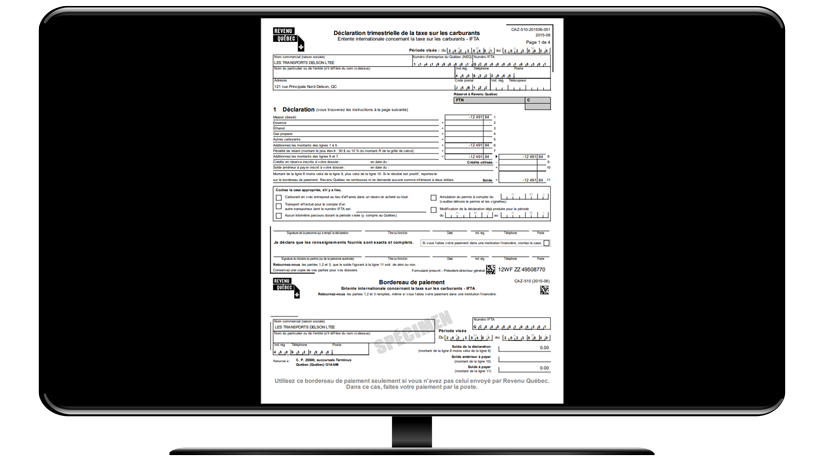

Generates IFTA reports

4.

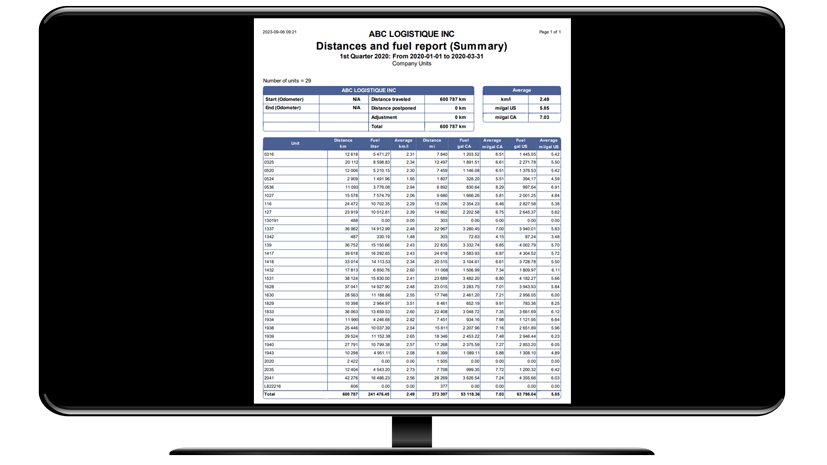

Compile your distances reports

Fuel Tax System benefits

Easy to use

Cloud based solution

Data import

Compiles your IRP data

Transmission of distance reports

Compliance of your reports

Want to learn more? Contact us now